Tesla Cybertruck is eligible for the $7,500 electric vehicle tax credit

In updates Friday, the U.S. Environmental Protection Agency (EPA) confirmed that some versions of the Tesla Cybertruck will be eligible for the electric vehicle tax credit – at least for models that ship in 2023.

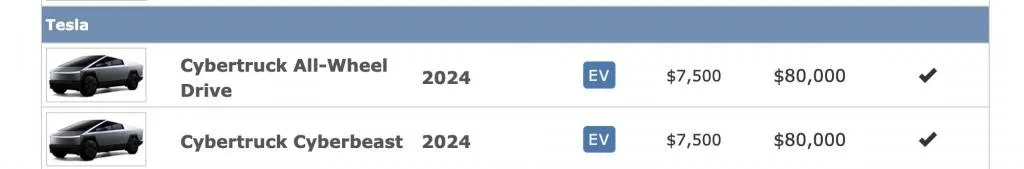

As announced just over a week ago, the Tesla Cybertruck will be available in all-wheel drive (dual-motor) version for $79,990 and Cyberbeast performance (tri-motor) model for $99,990. A single-engine, rear-wheel drive model is scheduled to hit the market in 2025.

Here you will find information published on the EPA tax credit page gets a little confusing. The Cyberbeast qualifies for the $7,500 electric vehicle tax credit, with an MSRP limit of $80,000.

According to the EPA, the Tesla Cybertruck is eligible for a $7,500 electric vehicle tax credit. – 12/2023

Nowhere else on the EPA website is a model that starts well over $80,000 listed as qualifying. It’s also unlikely that Tesla intends to lower the Cyberbeast below $80,000 for deliveries before the end of 2023, the period of the EPA’s current list. Green Car Reports has contacted the EPA for clarification; Tesla does not respond to press inquiries.

It’s not just the price that doesn’t quite match Tesla’s original promised starting price of $39,900. While a range of “500+ miles” was suggested when the Cybertruck concept was unveiled in 2019, the Production Tesla Cybertruck If the vehicle arrives more than four years later, it will travel an estimated 340 EPA miles in all-wheel drive form.

2025 Tesla Cybertruck – Courtesy of Tesla, Inc.

The positive thing is that through some lean engineering decisions, Tesla has managed to squeeze this range out of a reported battery capacity of just 123 kWh – more range than that Ford F-150 Lightning for example with less battery. However, to get anywhere close to the claimed 500 mile mark, you’ll need to opt for a “range extender” battery, which takes up part of the charging box and allows for a range of up to 470 miles.

However, it’s not surprising that the Cybertruck cuts the tax credit, which has been revised to focus on US-made, domestically sourced electric vehicles.

Tesla Battery Day Vertical Integration Overview

As it emphasizes in his Battery day Already in 2020, long before Biden’s electric car policy, Tesla is aiming to make batteries and the entire supply chain for them part of a vertically integrated – and localized – supply chain. The Cybertruck’s 4680 cylindrical cells are made in the USA and the Cybertruck is manufactured in Austin.

These models are not yet listed by the EPA for efficiency or range ratings, and may never be until lighter, single-engine versions come on the market. Models with a gross vehicle weight rating of more than 8,500 pounds are not required to report these figures at the time of sale.

However, not all Teslas qualify for the tax credit. Tesla has already indicated that the base LFP version of the Model 3 will not be eligible for the credit in 2024. That’s because it relies on cells manufactured abroad, at least for now.

2023 Tesla Model 3

Last month, the federal government released the final committed phase of the credit as outlined in the Inflation Reduction Act. The credit will be waived for electric vehicles that contain battery components supplied or assembled by a “foreign company of concern” (including China, Iran, North Korea and Russia).

According to this wording, an exclusion extends to corporate subsidies that operate elsewhere and are majority controlled by companies based in intra-group companies. So, depending on interpretation, the disqualified models could include US-made Volvo and Polestar electric vehicles (majority owned by China’s Geely) and European-made batteries from China’s CATL.

In 2025, the rule will be tightened even further – to cover critical minerals that come from or were processed by a questionable foreign company. Tesla’s vertical integration and control of its supply chain will likely pay off handsomely.